AL ADoR RT-1 free printable template

Show details

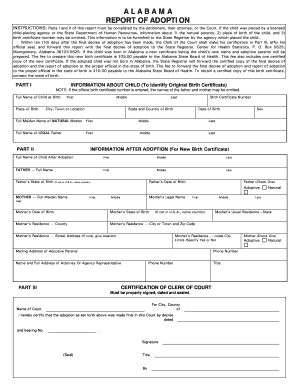

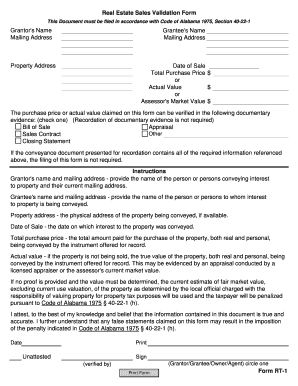

Date Print Unattested Sign Grantor/Grantee/Owner/Agent circle one verified by Print Form Form RT-1. Real Estate Sales Validation Form This Document must be filed in accordance with Code of Alabama 1975 Section 40-22-1 Grantor s Name Mailing Address Property Address Date of Sale Total Purchase Price or Actual Value Assessor s Market Value The purchase price or actual value claimed on this form can be verified in the following documentary evidence check one Recordation of documentary evidence...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign alabama form rt 1 pdf

Edit your alabama real estate validation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama rt 1 fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama rt 1 fillable form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit real estate sales validation form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alabama rt 1 sales fillable form

How to fill out AL ADoR RT-1

01

Obtain the AL ADoR RT-1 form from the relevant tax authority or their website.

02

Fill in your personal information, including your name, address, and identification number at the top of the form.

03

Indicate the type of tax you are reporting by checking the appropriate box.

04

Provide details of your income, including sources and amounts, in the designated sections.

05

Fill out any deductions or credits you are eligible for as specified in the instructions.

06

Calculate the total amount due or refund based on the information you provided.

07

Sign and date the form to certify that all information is accurate.

08

Submit the completed form either online or via mail to the designated tax office by the deadline.

Who needs AL ADoR RT-1?

01

Anyone who has taxable income and needs to report it to the tax authority.

02

Individuals or entities required to file taxes in the jurisdiction where AL ADoR RT-1 is applicable.

03

Taxpayers seeking to claim deductions or credits for their taxable income.

04

Business owners needing to report business income and expenses.

Fill

form rt 1

: Try Risk Free

People Also Ask about alabama real estate sales validation form

How to prove residency to Alabama Real Estate Commission?

You may submit a clear copy of a current driver's license, car tag receipt, deed to a home, lease agreement on a home or residential apartment, property tax bill, voter's registration card, or any other document acceptable to the Alabama Real Estate Commission.

Does Alabama have a standard real estate contract?

An Alabama residential purchase and sale agreement allows a buyer and seller to enter into a legally binding contract for the sale of real property. The main terms of the agreement will consist of a purchase price, downpayment, and financing terms (if any).

How long do you have to live in a house to avoid capital gains in Alabama?

Live in the house for at least two years If you sell a house that you didn't live in for at least two years, the gains can be taxable. Selling in less than a year is especially expensive because you could be subject to the short-term capital gains tax, which is higher than long-term capital gains tax.

Who pays real estate transfer tax in Alabama?

In Alabama, the transfer tax is usually paid by the buyer.

Do you have to pay capital gains when you sell your house in Alabama?

Yes. In general, income from the sale of Alabama property is required to be reported on an Alabama income tax return.

Is there capital gains tax on a house sale in Alabama?

Most home sales in Alabama will have no capital gains to claim. Individuals can exempt the first $250,000 in profit, while married couples filing jointly can deduct the first $500,000 of their profit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my alabama rt 1 form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your real estate validation form alabama directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit alabama form rt1 pdf straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing rt 1 form alabama.

How do I fill out the real estate valuation form form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign alabama revenue form rt 1 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is AL ADoR RT-1?

AL ADoR RT-1 is a specific form used for reporting by certain entities to comply with regulatory requirements in Alabama.

Who is required to file AL ADoR RT-1?

Entities operating in Alabama that meet specific financial thresholds or regulatory guidelines are required to file AL ADoR RT-1.

How to fill out AL ADoR RT-1?

To fill out AL ADoR RT-1, gather the required financial information, complete each section of the form accurately, and ensure all data aligns with your records.

What is the purpose of AL ADoR RT-1?

The purpose of AL ADoR RT-1 is to ensure that entities comply with state regulations by reporting relevant financial data and activity.

What information must be reported on AL ADoR RT-1?

AL ADoR RT-1 must include information on financial performance, transactions, and other details required by state regulation.

Fill out your AL ADoR RT-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Alabama 1 Printable is not the form you're looking for?Search for another form here.

Keywords relevant to alabama form rt 1

Related to al rt 1

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.